TraceLoans is not just another financial platform; it’s a revolutionary service designed to empower entrepreneurs, small business owners, and individuals seeking financial solutions. With a mission rooted in empowerment, TraceLoans connects aspiring entrepreneurs with the resources they need to thrive. In this comprehensive guide, we’ll explore everything you need to know about TraceLoans, its benefits, unique features, and how it stands apart from other financial services. We’ll also address common questions about TraceLoans to help you make informed decisions.

What Is TraceLoans?

TraceLoans is an innovative platform that bridges the gap between entrepreneurs and essential financial resources. Whether you’re starting a new business or scaling an existing one, TraceLoans provides tailored loan options, business tools, and guidance to help you succeed. By connecting borrowers with reliable lenders, TraceLoans ensures access to affordable financing while simplifying the entire loan application process.

Key Features of TraceLoans:

- Tailored Loan Solutions: Customized financing options to suit diverse needs.

- User-Friendly Platform: A seamless online experience for both lenders and borrowers.

- Resource Access: Tools and educational content to support financial literacy.

- Fast Approval Process: Accelerated timelines for loan approvals.

- Transparent Terms: No hidden fees, ensuring borrowers fully understand their commitments.

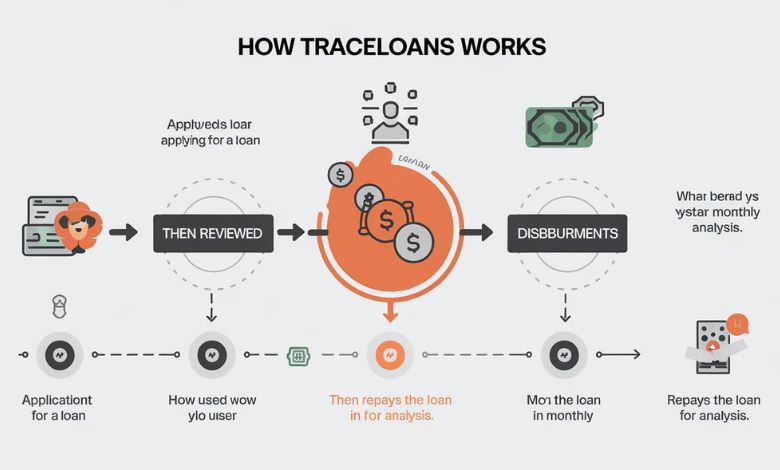

How TraceLoans Works

TraceLoans simplifies the borrowing process by eliminating the complexities typically associated with loan applications. Here’s how it works:

Step 1: Create an Account

Sign up on the TraceLoans platform by providing basic information about yourself or your business. The user-friendly interface ensures a hassle-free registration process.

Step 2: Define Your Needs

Specify the type of loan you require. Whether it’s a small business loan, startup funding, or personal financing, TraceLoans matches you with suitable options.

Step 3: Connect with Lenders

Once your profile is complete, TraceLoans connects you with trusted lenders who offer competitive rates and terms.

Step 4: Submit an Application

Complete your loan application directly through the platform. TraceLoans guides you through each step to ensure accuracy and completeness.

Step 5: Receive Approval

After submitting your application, lenders review it and provide feedback. Once approved, funds are disbursed promptly.

Also Read: Bebasinindo – A Gateway to Tradition and Community

Benefits of Using TraceLoans

TraceLoans goes beyond traditional financial services by focusing on empowerment and growth. Here are some of the key benefits:

1. Accessibility

TraceLoans caters to a wide range of borrowers, including those with limited credit histories. The platform ensures that financial resources are accessible to everyone, regardless of their background.

2. Empowerment Through Education

TraceLoans offers a wealth of resources, including articles, videos, and financial tools, to enhance financial literacy. This empowers users to make informed decisions.

3. Flexibility

With various loan types and repayment options, TraceLoans provides flexibility to suit different financial situations.

4. Transparency

Unlike many financial institutions, TraceLoans prioritizes transparency. Borrowers are given clear, concise information about loan terms, interest rates, and repayment schedules.

5. Support for Entrepreneurs

TraceLoans’ primary mission is to support entrepreneurship. By providing accessible funding and business resources, the platform helps entrepreneurs turn their ideas into thriving ventures.

TraceLoans vs. Traditional Financial Institutions

While traditional banks and financial institutions offer loans, TraceLoans provides a more tailored and efficient solution. Let’s compare the two:

| Feature | TraceLoans | Traditional Institutions |

| Approval Speed | Fast, often within days | Weeks to months |

| Eligibility Criteria | Flexible | Strict |

| Transparency | High | Variable |

| Resource Access | Extensive | Limited |

| User Experience | Seamless | Often complex |

Who Can Benefit from TraceLoans?

TraceLoans is designed for a diverse audience, including:

- Aspiring Entrepreneurs: Gain access to startup funding and business tools.

- Small Business Owners: Secure working capital to grow your business.

- Freelancers and Gig Workers: Obtain financial resources to support independent work.

- Individuals with Limited Credit: Access flexible loan options with less stringent criteria.

Tips for Maximizing Your TraceLoans Experience

To make the most of TraceLoans, consider these tips:

1. Clearly Define Your Goals

Before applying for a loan, identify your financial needs and goals. This will help you choose the right loan type and amount.

2. Maintain Accurate Records

Ensure that all your financial documents and information are up to date. This can expedite the approval process.

3. Utilize Educational Resources

Take advantage of the financial literacy tools and resources offered by TraceLoans to improve your financial management skills.

4. Compare Lenders

TraceLoans provides access to multiple lenders. Compare their terms and conditions to select the best option for your needs.

5. Stay Informed

Regularly check the TraceLoans platform for updates, new features, and additional resources.

Also Read: Lillienu – Revolutionizing AI, ML, and Cloud Camping!

Real-Life Success Stories with TraceLoans

Case Study 1: Turning Dreams into Reality

Sarah, a budding entrepreneur from Chicago, used TraceLoans to secure funding for her organic skincare startup. With the financial support and business tools provided by TraceLoans, Sarah’s business flourished, and she now sells her products nationwide.

Case Study 2: Expanding a Family Business

John and Lisa, owners of a small family restaurant in Texas, needed additional capital to renovate their space and add outdoor seating. TraceLoans connected them with a lender offering favorable terms, enabling them to enhance their business and attract more customers.

Case Study 3: Overcoming Financial Challenges

Tom, a freelance graphic designer, faced financial difficulties during a slow work season. TraceLoans helped him obtain a personal loan with flexible repayment terms, allowing him to stay afloat and focus on growing his client base.

Also Read: Çeciir – The Heart of Chickpea Cuisine and Culture

Frequently Asked Questions (FAQs) About TraceLoans

What types of loans does TraceLoans offer?

TraceLoans offers a variety of loans, including:

- Business loans

- Startup funding

- Personal loans

- Debt consolidation loans

How long does the loan approval process take?

The approval process is fast, often taking only a few days, depending on the complexity of the application.

Are there any fees associated with using TraceLoans?

TraceLoans is committed to transparency. Any fees are clearly outlined during the application process, with no hidden charges.

Can I use TraceLoans if I have bad credit?

Yes, TraceLoans caters to individuals with diverse credit histories. Flexible eligibility criteria ensure that more borrowers can access financial resources.

How does TraceLoans ensure the security of my information?

TraceLoans uses advanced encryption and security protocols to protect user data, ensuring a safe and secure experience.

Is TraceLoans available nationwide?

Yes, TraceLoans serves customers across the United States, making financial resources accessible to a broad audience.

Conclusion

TraceLoans is more than just a lending platform; it’s a lifeline for entrepreneurs and individuals striving for financial stability and growth. With its user-centric approach, tailored loan options, and commitment to empowerment, TraceLoans stands out as a trusted partner in financial success. Whether you’re launching a new business, expanding operations, or seeking personal financing, TraceLoans is here to help you achieve your goals.

+ There are no comments

Add yours